Alimony is tax deductible for the person paying, and a taxable income for the person receiving in the state of Florida. Most people are unaware of this fact, and not knowing this can be a detriment if you are being awarded alimony by the courts. It is important to keep record of your alimony payments because of the tax implications and to present the court if there are any questions about payment or receipt. If you need help modifying your Alimony Payments, contact Mark E Sawicki, P.A. immediately. He and his staff are here to help you get your Alimony Payments under control.

Are certain records worth keeping regarding Alimony in Florida?

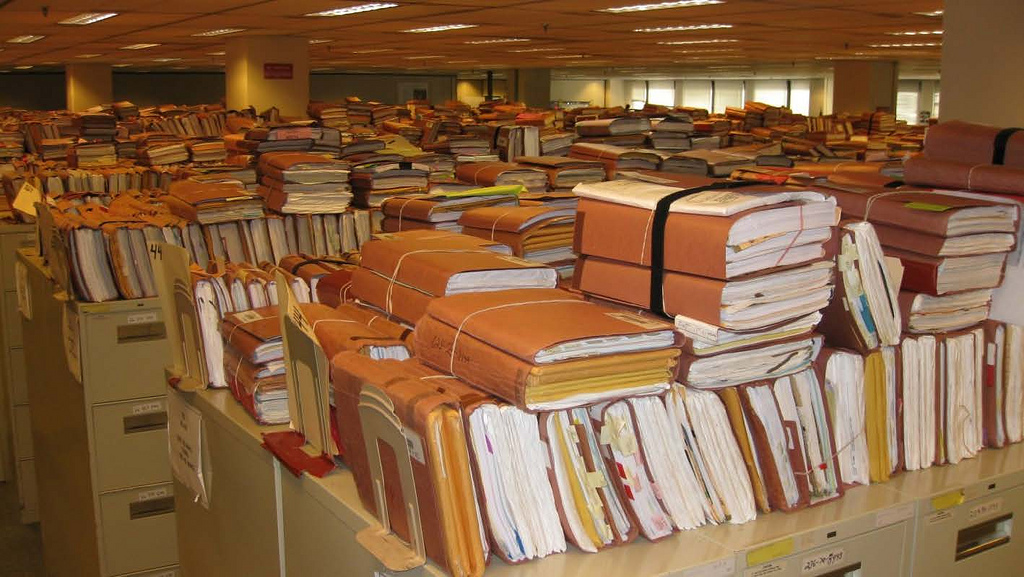

Any time you pay or receive alimony payments it is wise to retain the records. This is to make sure that you are able to present them to the courts if asked, and the IRS for tax reasons. If you do not keep track of the alimony payments, the IRS may fine you the amount owed.

Should the payer of Alimony and recipient of Alimony keep records?

Yes. The person paying should keep a list showing each payment, original copies of the checks, and if the alimony is paid in cash, a written and signed receipt from the recipient. The records should be kept for at least 4 years and it is recommended to keep digital copies forever. The receiver of the alimony payments should also keep track of when the alimony was received, how much was received, the bank and account number from which the money is drawn, and if they receive payments in cash, a copy of the written and signed receipts given to the payer.

What could happen if I don’t keep records of Alimony?

There are a couple of things that could go wrong if you do not keep records of alimony payments. First, the courts could request the records in order to restructure or modify the alimony program. If you do not have the records, the courts may rule for the alimony to be increased. Second, the IRS may contest the amounts of alimony received. If one party decides to commit fraud and claim certain amounts were not paid or received, if there are records, these claims can easily be disproven.

Keeping records is a great practice to get into with any financial information. It is especially important to keep records of your alimony payments and receipts because there are many interested parties who need to know this information. They include ex spouses, the courts, and the IRS. If you do not keep records of your alimony payments, it can become problematic when any of these parties request the information. If you live in the Palm Beach, Broward, or Miami-Dade County area of Florida and are going to court over alimony payments, contact Mark E. Sawicki, P.A. Mark is a State Bar Licensed Attorney who knows all about Alimony payments and Family Law.